Bloggfærslur mánaðarins, ágúst 2015

Hugleiðingar varðandi kaup á hlutabréfum Haga og Sjóvá

31.8.2015 | 06:22

Ég fjárfesti í hlutabréfum Haga hf. í sumar. Valið stóð í mínum huga á milli hlutabréfa þess félags og Sjóvá hf. Síðan þá hefur gengi hlutabréfa Sjóvá hækkaðum rúmlega 20% en gengi hlutabréfa Haga „aðeins“ um rúmlega 5%. Val mitt var samkvæmt þessu þokkalegt en augljóslega hefði ég átt að veðja á hinn hestinn.

Fólk spyr mig oft hvaða þætti ég einblíni á þegar ég fjárfesti í hlutabréfum. Einn þáttur tengist ávallt virði þeirra. Ef hlutabréf fyrirtækja eru ekki með dulið virði, sem gæti verið í formi dulinna vaxtartækifæra, hagnaðar í undirliggjandi eignum eða einfaldlega verðmati sem vanmetur eðlilegan hagnað frá rekstri (gerist oft þegar að neikvæðar fréttir eru ríkjandi tengdum framtíðarhorfum fyrirtækja), þá er ekki ástæða til að fjárfesta í bréfunum. Hér að neðan eru stutt dæmi.

Sjóvá

Ástæðan fyrir því að ég var að hugsa um að fjárfesta í Sjóvá var að ég taldi að félagið kæmi til með að innleysa töluverðan gengishagnað vegna skuldabréfasafns félagsins. Ég taldi líklegt að ávöxtunarkrafa skuldabréfa kæmi til með að lækka mikið í sumar í framhaldi af fréttum varðandi afnámi gjaldeyrishafta. Sjá umræðu hérna – http://www.mbl.is/vidskipti/pistlar/marmixa/1787102/. Fyrirtækið er auk þess vel rekið og hefur skilað hagnaði af undirliggjandi rekstri undanfarin misseri. Hlutabréf félagsins virtust vera eðlilega verðlögð en var tekið tillit til hugsanlega innleysts gengishagnaðar?

Við nánari athugun sá ég að þrátt fyrir að vaxtastig lækki töluvert mikið, sem ég gerði ráð fyrir á þeim tímapunkti, þá hefði það ekki umtalsverð áhrif á skuldabréfasafn félagsins. Líftími flestra bréfa í eigu félagsins er tiltölulega stuttur eða að meðaltali rétt rúmlega 3 ár eftir fyrsta ársfjórðung þessa árs en var í upphafi árs tæplega 4 ár (http://www.sjova.is/files/fjarfestar/2015_Afkoma_3M.pdf, sjá blaðsíðu 9). Þar sem að lengri líftími skuldabréfa gerir þau meira næm fyrir vaxtabreytingum á mörkuðum þá hefðu nýlegar lækkanir á ávöxtunarkröfu skuldabréfa haft meiri áhrif á afkomu fyrirtækisins hefði meðallíftími skuldabréfa í safni Sjóvá verið lengri. Fram kom í tilkynningu frá Sjóvá að vænt arðgreiðsla hefði aukið eign félagsins í innstæðum og lausafjársjóðum. Það var því erfitt að meta hversu mikil áhrifin yrðu varðandi meðallíftíma skuldabréfasafnsins í framhaldi af háu arðgreiðslunni (það reyndist vera 3,5 ár samkvæmt nýlegu árshlutauppgjöri).

Hugsanlega hef ég engu að síður vanmetið áhrifin því að eins og áður sagði þá hafa hlutabréf félagsins hækkað töluvert mikið síðan ég fór í gegnum þessar pælingar og missti ég þar af góðu kauptækifæri. Auk þess, þrátt fyrir að gera ráð fyrir skarpri vaxtalækkun á mörkuðum (ekki skammtímavexti Seðlabankans), gerði ég ekki ráð fyrir því að lækkun vaxtastigs á markaði yrði jafn skjótt og raun bar vitni. Því má við bæta að ég keypti einnig ríkisbréf (RB31) með langan líftíma á sama tíma þannig að segja má að ég hafi tekið beina frekar en óbeina stöðu í þeirri trú minni að ávöxtunarkrafa skuldabréfa kæmi til með að lækka.

Hagar

Ég taldi að kaup í Högum væri álitleg á þessum tímapunkti vegna nokkurra þátta. Einn var sú staðreynd að hlutabréf í félaginu höfðu lækkað um um það bil 15% (að teknu tilliti til arðgreiðslu) frá hæstu hæðum verðgildis þeirra nokkrum mánuðum áður. Ástæða lækkunarinnar átti sér að ákveðnu leyti eðlilegar skýringar. Samdráttur í hagnaði hafði nýlega átt sér stað en ég tel hann vera tímabundinn. Auk þess er ljóst að tilkoma Costco keðjunnar á íslenskan markað leiði til aukinnar verðsamkepnni og minnki framlegð Haga að einhverju leyti. Raunar hafði ég selt bréf mín í Högum árið 2014 þegar að tilkynnt var að Costco kæmi til landsins sem myndi draga úr hagnaði Haga. Þar var ég e.t.v. of bráður á mér því að reynslan í Bandaríkjunum hefur sýnt að verslanir eins og Target og Wal-Mart geta hæglega keppt á sömu svæðum og Costco. Það er þó óneitanlega stórt spurningarmerki að hvaða marki tilkoma Costco dragi úr framlegð Haga næstu árin.

Það eru aftur á móti önnur vaxtartækifæri fyrir Haga. Ég taldi að áhrif af afnámi hafta kæmi til með að styrkja krónuna og að sú verðbólga sem óttast var að færi á skrið á vormánuðum yrði því minni. Því kæmi kostnaður innfluttra vara til með að lækka í íslenskum krónum talið og auka framlegð Haga til skemmri tíma (nýleg 3% lækkun IKEA á vörum sínum sýnir það svart á hvítu).

Það eru hins vegar fjórir aðrir þættir sem ég tel að komi til með að drífa hagnað Haga áfram næstu misseri.

- Afnám hafta og sú inngreiðsla sem kemur í ríkissjóð næstu misseri kemur til með að lækka skatta og bæta afkomu Íslendinga verulega mikið. Ég tel líklegt að það komi til með að hafa verulega góð áhrif fyrir rekstur Haga, þar sem að Íslendingar fari að kaupa meira á nýjan leik (vonandi þó ekki 2007 neyslu) sem ætti að auka tekjur Haga.

- Annað atriðið tengist fyrsta atriðinu. Með bættari hag ríkissjóðs myndast möguleikar til að afnema frekar tolla af vörum. Netverslun Íslendinga á fatnaði, auk kaupa á erlendri grundu, hefur dregið mjög úr sölu fatnaðar hérlendis. Afnám tolla gæti gert fatakaup að áhugaverðari kosti hérlendis. Upphæðirnar eru ekki verulegar en þó nægjanlegar til að auka hagnað fyrirtækisins.

- Á svipuðum nótum og tvö fyrrnefndu atriðin þá er vaxtakostnaður Íslendinga að lækka (ég fjalla nánar um það á næstunni). Með minni vaxtakostnað eykst rými til neyslu (aftur, ég vona að 2007 sé ekki handan hornsins) og vonandi þá líka aukins sparnaðar.

- Erlendir ferðamenn þyrpast til Íslands þessa daganna. Vera þeirra á höfuðborgarsvæðinu takmarkast ekki lengur við miðbæ Reykjavíkur heldur gista þeir um gjörvalt Reykjavíkursvæðið. Það eru meira að segja ókeypis skutlur að keyra þá í Kringluna svo þeir geti verslað meira. Þó svo að flestir ferðamenn kaupi varning í verslunum sérsniðnum að þörfum þeirra þá kemur aukning ferðamannastraumsins til með að auka veltu Haga. Vöxtur ferðaþjónustunnar dregur einnig það mikið vinnuafl til sín að aftur er vinnuafl farið að streyma til landsins, sem þýðir að viðskiptavinum Haga fjölgar.

Ef samdráttur verður mikill í heiminum, til dæmis með hruni kínversks hagkerfis eins og margir óttast þessa daganna, dregst ferðamannastraumur saman. Keðjuverkandi áhrif ættu sér væntanlega stað og neysla Íslendinga kæmi til með að dragast saman. Slíkt myndi óhjákvæmilega draga úr hagnaði Haga. Hlutabréf fyrirtækisins gætu hæglega hækkað um 20% í mínum huga en ekki mikið meira en það næstu mánuði. Að sama skapi er lækkun á bréfum félagsins líkleg gangi ofangreindar bjartsýnar forsendur ekki eftir. Fyrirtækið er í það stöndugum rekstri að ég tel líkur á miklu verðfalli á hlutabréfum fyrirtækisins ólíklegar. Má í þessu sambandi benda á að hlutabréf í Wal-Mart og Target hafa sveiflast lítið í verði síðustu árin í Bandaríkjunum en hlutabréf í Costco hafa aftur á móti meira en tvöfaldast í virði síðustu 5 ár. „Gömlu“ verlunarkeðjunnar halda velli en Costco er stækkandi fyrirtæki, en lítill vöxtur er reiknaður í virði „gömlu“ risanna en öllu meiri hjá Costco.

MWM

Rétt er að taka fram að ofangreint er ekki fjárfestingarráðgjöf. Gengi hlutabréfa getur lækkað og geta þau jafnvel orðið verðlaus. Það á við um gengi ofangreindra félaga líka. Gengi skuldabréfa sveiflast líka og geta þau einnig orðið verðlaus. Aldrei setja öll fjárfestingaregg þín í sömu körfuna.

English version

Reflections on Investing in Haga and Sjóvá Shares

I invested in Hagar shares this summer. The choice was in my mind between the shares of that company and Sjóvá. Since then, the stock price Sjóvá has risen more than 20% but the stock Haga "only" just over 5%. My choice was according to this reasonable but obviously I should have bet on the other horse.

People often ask me what aspects I focus on when I invest in equities. One factor always relates to their value. If the shares of companies do not have a hidden value, which could be in the form of latent growth opportunities, profits in the underlying assets or simply that the market price assessment underestimates reasonable future profits from operations (often happens when negative news dominate related prospects of companies), then there is no reason to invest in the shares. Below are brief examples.

Sjóvá

The reason why I was thinking about investing in Sjóvá was that I thought the company would redeem substantial trading gains in its bond portfolio. I considered it likely that bond yields would decline sharply in the summer in the wake of the news regarding the lifting of capital controls. The company is also well run and has generated profits from continuing operations in the recent past. Shares of the company appeared to be reasonably priced but did the pricing take into consideration the potential realized gains?

On closer examination, I saw that despite the fact that interest rates will fall quite a lot, which I assumed at that point, it would not have a significant impact on its bond portfolio. The duration (Macauley, i.e. the weighted average lifespan) of most bonds owned by the company is relatively short or an average of slightly more than 3 years after the first quarter of this year than at the beginning of almost 4 years (http://www.sjova.is/files/fjarfestar/2015_Afkoma_3M.pdf, see page 9). Because bonds with long duration makes them more sensitive to interest rate changes in the markets, the recent decline in bond yields would have had a greater impact on the performance of the company had an average maturity of bonds in the Sjóvá portfolio been longer. It was revealed in a statement from Sjóvá the expected dividend had increased investments in cash. It was difficult to assess the extent of the impact would be for the lifetime of the bond portfolio following the massive dividend payment.

I have possibly, nevertheless, underestimated the effect, as previously said the company's shares have risen quite a lot since I went through these thoughts and a good buying opportunity passed me by. In addition, I did not expect the reduction of interest rates in the market would be as quick as it did, despite expecting interest rates falling a great deal. It can be added that I also bought bonds with long maturities so it could be said that I have took a direct rather than indirect exposure in the belief that bond yields would drop.

Hagar

I felt that Hagar shares was a promising investment at this point due to several factors. One was the fact that the company's shares had fallen by about 15% (taking into account dividends) from a peak value of a few months before. This decrease can to some extent be explained. The decline in profits had recently taken place, but I believe it to be temporary. Moreover, it is clear that the introduction of the Costco chain in the Icelandic market will increase price competition and reduce Hagar margins to some extent. I had actually sold my shares in Hagar when it was initially announced that Costco was entering the market. The experience in the US have shown that stores like Target and Wal-Mart can easily compete in the same areas and Costco. However, it is undeniably a big question to what extent the emergence Costco reduces Hagar´s margin in the coming years.

There are, however, other growth opportunities for Hagar. I thought that the impact of liberalization would tend to strengthen the currency and the inflation fear in the spring thus in the upper range. The strengthening of the currency would lower the cost of imports increase Hagar´s margins short term (recent 3% decrease of IKEA is a clear example).

There are, however, four other factors that I think are expected to drive Hagar´s profits continuation in coming seasons.

- Removal of currency restrictions and a payment the Treasury expects receiving in the near term is going to reduce taxes and improve performance Icelanders’ well-being significantly. I think believe this will have a significant positive effect on the operations of Hagar, with Icelanders consuming more again (hopefully not “2007” consumption), which should increase Hagar´s revenue.

- The second relates to the first item. With the Treasury having more income it has increased options to abolish further customs duties on products. Icelanders have increasingly shopped their clothing and other products abroad, often via the Internet. The reduction in tariffs could make such shopping more of a viable choice within Icelandic shores.

- In a similar vein as the two aforementioned items is that interest rates in Iceland are falling (I shall discuss that in the near future). With lower interest expenses, there is more opportunities to increase consumption (again, I hope that “2007” is not around the corner) and then hopefully also increase savings.

- Foreign tourists flock to Iceland these days. Their stays are no longer limited to the center of Reykjavik but of the whole Reykjavik area. There are even free shuttles to drive them to the mall so they can shop more. Although most tourists buy goods in stores adapted towards their needs, the increase in tourism is bound to increase the turnover of Hagar. The growth of tourism also draws an added labor force that has begun flowing into the country, which means that the numbers of Hagar´s customers increases.

If the recession occurs world-wide, for example, the collapse of the Chinese economy as many fear these days, tourism will decrease. This would inevitably reduce Hagar´s profits. The company's stock could easily increase by 20% in my mind but not much more than that over the coming months. Similarly, the decline in the company's stock are likely if the above optimistic assumptions do not pan out. The company is in it a sound business, I thus believe the probability of large price drop in shares of the company unlikely. In this context it may be pointed out that shares in Wal-Mart and Target have fluctuated little in price in recent years in the US stock market while shares in Costco have in turn more than doubled in value over the past 5 years. The “old” retail chains thus stand their ground but Costco is a growing entity, but while little growth is priced in the “old” retail chains, moderate growth is priced in the Costco shares.

MWM

This writing is not an investment advice. Stock prices can go down and stocks can even become worthless. That applies to the stocks mentioned in this article. Bonds prices also fluctuate and can also become worthless. Never put all of you investment eggs in the same basket.

Viðskipti og fjármál | Breytt s.d. kl. 11:05 | Slóð | Facebook | Athugasemdir (0)

Kínversk bóla

25.8.2015 | 09:34

Ég hitti kínverskan hagfræðing árið 2011 í framhaldi af fyrirlestri sem ég hélt í New Jersey varðandi íslenska hrunið. Hann sagði að afar margt sem fram kom í fyrirlestri mínum svipaði til ástandsins í Kína um þær mundir. Fasteignabóla var þá þegar farin að myndast og var hún jafnvel sprungin. Hans helstu áhyggjur voru að hagvöxturinn sem ríkti, og hafði gert í mörg ár, dyggði til að blása enn frekar í þá verðbólu sem var að myndast þar og að slíkt kæmi til með að breiðast yfir í aðrar afurðir fjármálamarkaða.

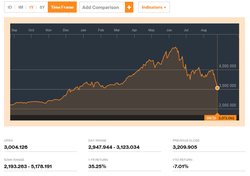

Áhyggjur hans hafa komið á daginn. Langt er síðan að ljóst var að fasteignabóla hefði í raun myndast og einnig sprungið. Engu að síður héldu kínversk hlutabréf að hækka í virði. Þessi þróun svipar til þess þegar að fasteignabóla sprakk í Bandaríkjunum árið 1925 en nokkrum árum síðar hækkuðu hlutabréf mikið áður en hinn mikli skellur kom. Hækkunin á kínverskum hlutabréfum líktist þó meira þeirri hækkun sem átti sér stað í tæknifyrirtækjum skráð á NASDAQ vísitölunni árin 1998-2000 (byrjun árs 2000). Svona leit NASDAQ hlutabréfavísitalan út frá lok apríl 1999 til sama tíma ársins 2000 (heimild: Google Finance).

Gengi kínversku hlutabréfavísitölunnar hefur hækkað með svipuðum hætti síðustu 12 mánuði eins og sést hér að neðan (heimild: Bloomberg.com).

Því hefur lengi verið spáð að vöxtur efnahagsins í Kína komi til með að dragast saman. Það er ekki þar með sagt að samdráttur væri nauðsynlega í spilunum, einfaldlega minni vöxtur. Þetta virðist ákveðinn hluti almennings í Kína ekki hafa verið meðvitaður um. Sígild einkenni hlutabréfabóla er uppspretta af miklum hagvexti í mörg ár og þrátt fyrir að hættumerki séu til staðar fer almenningur að trúa því að hagvöxturinn verði óendanlegur. Aukið aðgengi fólks í Kína að fjármagni leitaði síðan í hlutabréfamarkaðinn þar sem að hækkun hlutabréfa veitti þá tálmynd að þau væri góð fjárfesting (oft er innstæða fyrir hækkun hlutabréfa) og almenningur þar fór að fjárfesta í bréfum einungis af því að því að vinir og vandamenn höfðu gert slíkt hið sama og hagnast mikið. Skuldsetning almennings þar er í sögulegum hæðum og hefur aukist gríðarlega hratt eins og þessi frétt dregur vel saman. Eins og kínverski hagfræðingurinn sagði fyrir nokkrum árum síðan, margt svipar til ástandins í Kína síðastliðin ár (og fallsins þessa daganna) og á Íslandi 2003-2008.

MWM

Hér er hlekkur af frétt á RÚV sem birtist í morgun varðandi þetta efni. Það var ónákvæmt hjá mér að segja að frekari lækkanir væru líklegar, betra hefði verið að segja að þær kæmu mér ekki á óvart.

Viðskipti og fjármál | Breytt s.d. kl. 12:26 | Slóð | Facebook | Athugasemdir (0)

Selja Landsbankann og hugsanlegar höfuðstöðvar í leiðinni

6.8.2015 | 12:06

Töluverður umboðsvandi virðist ríkja varðandi Landsbankann þessa daganna. Bankinn vill byggja höfuðstöðvar í miðbænum sem fyrirséð er að verði dýrar í byggingu. Stjórnendateymi bankans telur að sá kostnaður fáist til baka þegar að til lengra tíma er litið.

Ríkið er langstærsti hluthafi bankans. Engu að síður hafa talsmenn helstu ráðamanna landsins opinberlega lýst yfir efasemdum á slíkum áformum. Í þeim hópi eru alþingismenn sem nú mynda meirihluta ríkisstjórnarinnar og jafnvel leiða hana. Maður skyldi ætla að þeir réðu hvað bankinn gerir og gerir ekki.

Það er einfalt að leysa þetta mál. Ríkið ætti að selja bankann. Umræða hefur verið að fara svokölluðu norsku leiðina í þeim efnum, sem felst í því að ríkið selji 60% hlut og ætti eftir 40%. Þannig réðu öfl sem hefðu hagsmuni bankans í fyrirrúmi hvað arðsemi varðar. Aftur á móti ætti ríkið áfram hlut í bankanum þannig að það hefði ákveðið neitunarvald sé bankinn að færast á braut þar sem að samfélagsleg gildi væru hvergi lengur sjáanleg.

Með þessu myndi stjórn bankans, skipuð aðallega af einstaklingum í umboði stærstu eigenda bankans (að ríkinu undanskildu), taka ákvörðun um það hvort að ný bygging ætti að rísa í miðbænum, á öðrum stað eða hvort nauðsynlegt sé yfir höfuð að byggja nýja byggingu. Væri niðurstaðan sú að byggingin væri fjárhagslega hentug þá myndu eigendur bankans samþykkja það og hlutur ríkisins í slíkri byggingu yrði "einungis" 40%.

Þessi hugmynd er ekki ný af nálinni. Fjallaði ég til að mynda um hana varðandi sölu á HS Orku fyrir nokkrum árum síðan og einnig fjallaði fjármálaráðherra um þetta í vor.

Eigið fé bankans var rúmlega 230 milljarða króna í upphafi 2. ársfjórðungs á þessu ári. Miðað við eðlilegan hagnað væri það komið í það minnsta 250 milljarða króna verði 60% hlutur bankans seldur á næstu 12-18 mánuðum. Hagnaður Landsbankans á seinasta ári var 30 milljarða króna eftir skatta. Miðað við margfaldarann 1,2 á eigið fé bankans yrði markaðsvirði hans ríflega 300 milljarða króna. Sé hagnaður ársins 2014 margfaldaður með 12 væri markaðsvirðið 360 milljarða króna. Með því að selja 60% hlut í bankanum fengi ríkið samkvæmt ofangreindum forsendum í kringum 200 milljarða króna í sinn hlut en ætti eftir sem áður 40% hlut í bankanum.

MWM